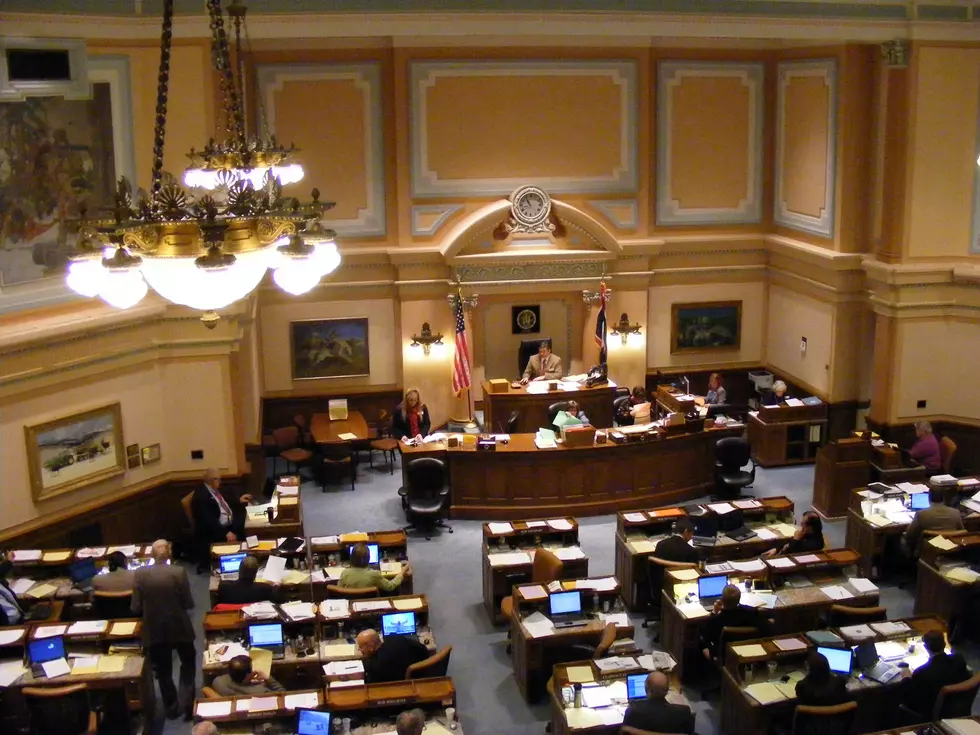

Wyoming Income Tax Bills Die In Legislature Friday

A pair of income tax bills died in the Wyoming Legislature on Friday when they failed to meet a deadline for introduction into the 2020 session.

House Bills 64 and 147 are dead for this session. Perhaps the bigger surprise was the failure of House Bill 64, the ''National Corporate Recapture Act." The bill was sponsored by the Joint Revenue Interim Committee and received a fair amount of media coverage leading up to the 2020 session.

The legislation would have imposed a 7 percent corporate income tax on companies with over 100 shareholders as Wyoming to diversify its revenue streams in the face of declining tax revenues from the struggling coal industry.

Opponents had argued that the corporate income tax would be the first step in instituting a statewide corporate and personal income tax and that the companies paying the tax would simply pass the increased costs on to consumers.

A somewhat similar bill failed to win approval in the 2019 legislature, despite the backing of much of the legislative leadership.

Probably less surprising on Friday was the death of House Bill 147. That legislation would have imposed a four percent income tax on both personal and corporate incomes over $200,000, with tax credits for a number of other taxes already paid, including such things as sales and ad valorem taxes. The proposal would have raised about $115,000,000 per year for state schools.

But one of the bill's sponsors, Sen. Chris Rothfuss (D-Albany County), said earlier in the week that he knew the bill would probably not win final approval in the legislature and that the proposal was mostly designed to spark a broader conversation about income taxes and state revenues.

More From KGAB