Personal Income Tax Bill Filed In Wyoming Legislature

A bill that would impose a four percent personal income tax in Wyoming has been filed for the 2021 Legislative session.

You can read House Bill 182 here.

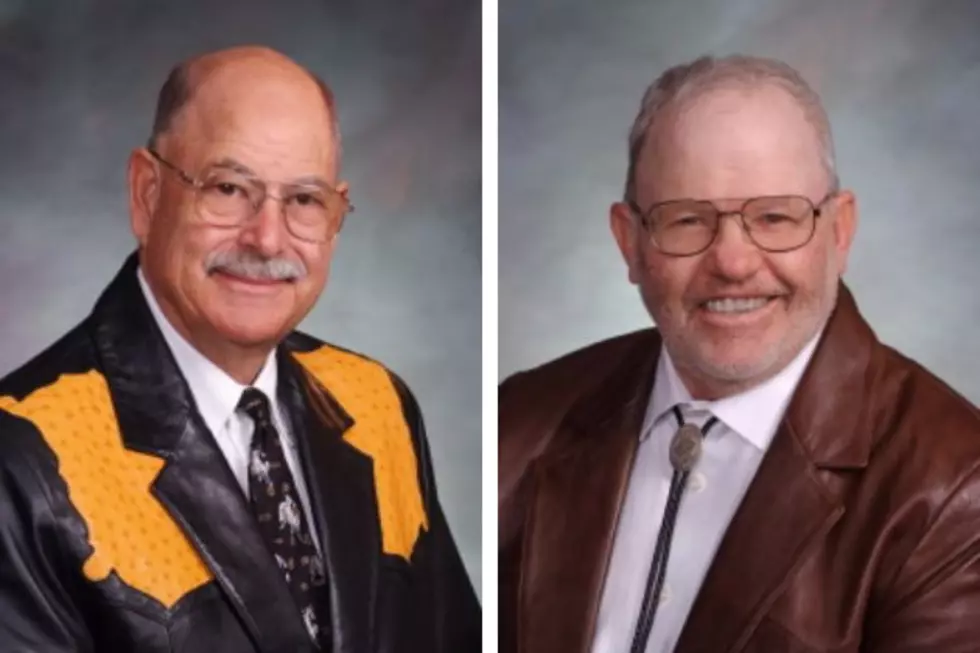

It is sponsored by Representative(s) Yin and Connolly and Senator(s) Rothfuss. The proposed 4 percent personal income tax would raise an estimated $337 million per year for the Wyoming School Foundation program.

That amount would more or less erase a projected $300 million school funding deficit that is currently projected for school funding in the state.

Unlike a personal income tax bill proposed in the legislature in 2020, the latest proposal would apply to all taxpayers, not only those making over $200,000 per year. But sales and other taxes paid would be credited against the amount owed in state income taxes.

Wyoming is facing major revenue shortfalls due to low energy prices and a recent Biden administration moratorium on new oil and gas leases on federal lands. The biggest shortfalls are in school funding.

Past Wyoming Supreme Court decisions have ruled that paying for education is the top priority of state government under the Wyoming Constitution.

Many Wyoming lawmakers are expecting another lengthy and expensive court fight over education funding in the near future. Such legal battles have been fought in the state dating back to the Washakie Decision in 1980.

20 Words and Phrases That Are So 2020

More From KGAB