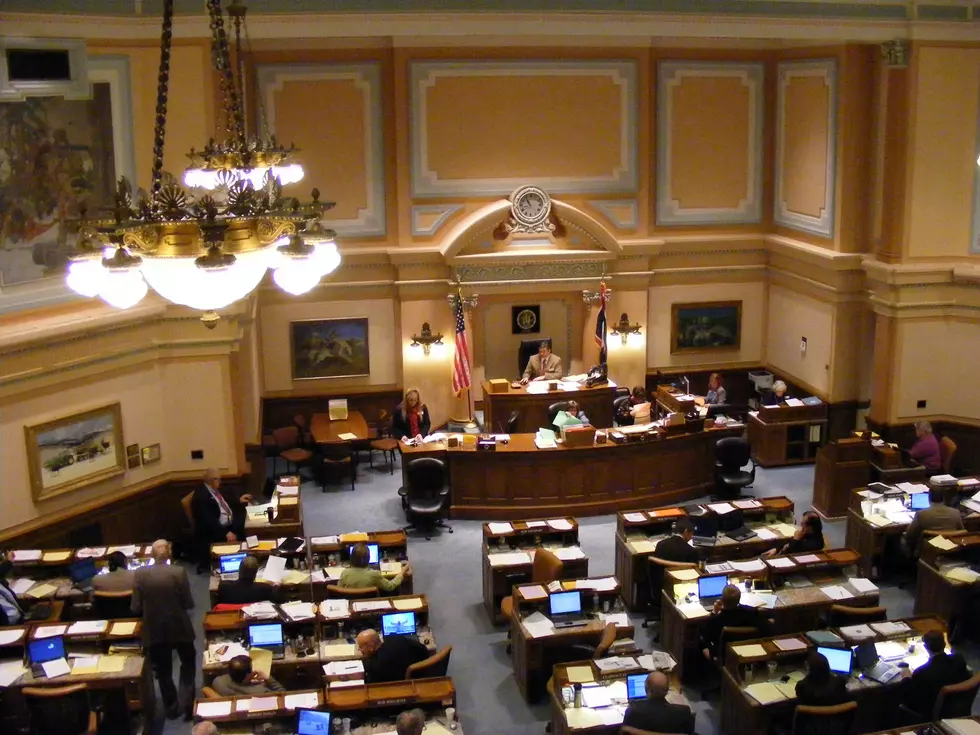

Wyoming Internet Sales Tax Bill Gets Initial Approval

A bill calling for the collection of sales taxes on internet purchases made in Wyoming has passed it's first test in the Wyoming Legislature.

House Bill 19 would demand payment of the state sales tax by internet vendors who sell at least $100,000 worth of their product in the state or record at least 200 sales in the Cowboy State. The measure also calls for the state to take court action to enforce the collection if that is needed.

The proposal passed a House Committee of the Whole vote on Friday, but still would need to clear several more hurdles in both houses of the legislature before being sent to Governor Matt Mead for his consideration.

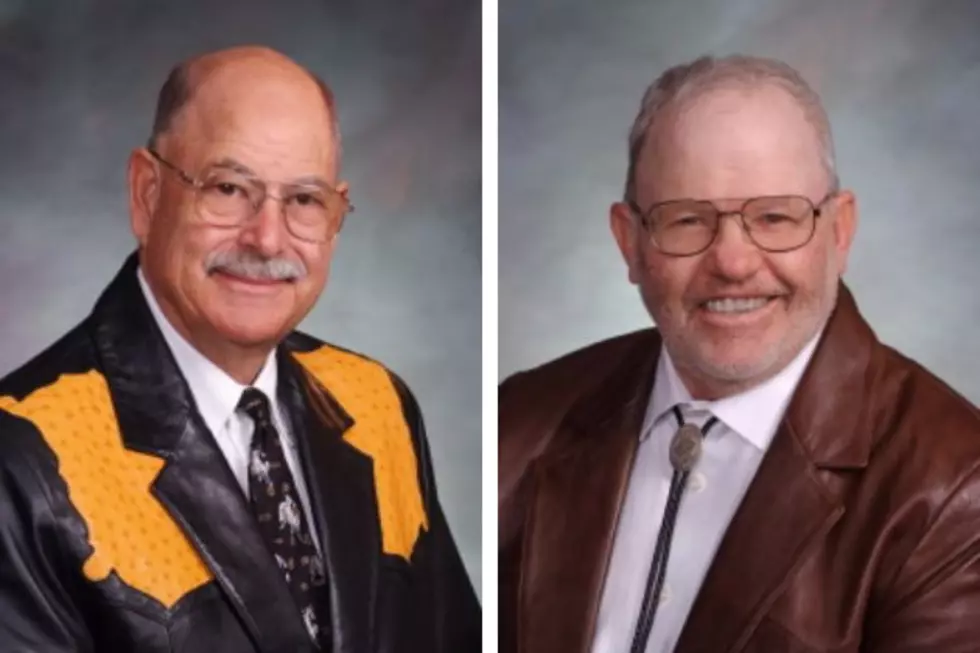

In house debate on the measure Friday, Rep. Landon Brown (R-HD9) told lawmakers the internet sales tax would not be a new tax, since state law already mandates the collection of sales taxes on internet purchases in the state.

Technically Wyoming residents who make internet purchases are supposed to fill out paperwork on the items they buy and pay a sales tax, but that law is not being enforced in the state.

Brown says the bill would put the burden of collecting sales taxes on the sellers.

Rep Bunky Loucks (R-HD 59) told lawmakers that in the current economic downturn the state can't afford to let the money owed the state on sales tax purchases go uncollected. A recent study found the state is losing out on roughly $29 million annually by not collecting sales taxes on internet purchases.

Supporters of the measure say it may require a U.S. Supreme Court ruling on the issue to force the collection of the taxes.

South Dakota recently passed a law requiring the collection of state sales taxes on internet sales, and supporters of the Wyoming measure say that case could provide a test of whether states can actually enforce collection of the taxes on internet purchases.

More From KGAB