Wyoming Corporate Income Tax Bill Tabled In Committee

A bill that would have imposed Wyoming's first-ever corporate income tax was tabled in a Senate committee Tuesday night, effectively killing the measure for this session.

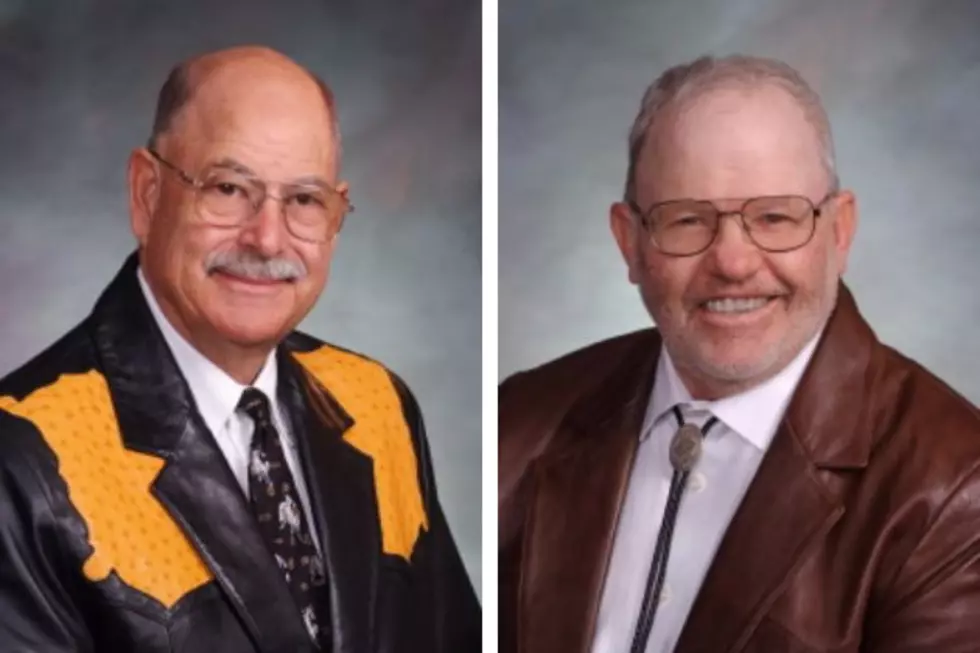

Senate Corporations, Elections, and Political Subdivisions Committee Charman Bill Landen [R-Natrona County] tabled the measure without a vote Tuesday night.

While the bill could theoretically still be considered, Wednesday is the last day for bills to be approved by committee for the 2019 session, and the Corporations Committee is not scheduled to meet again prior to the deadline.

House Bill 220 would have imposed an income tax of up to 7 percent on companies of over 100 shareholders who do business in at least 29 states.

Supporters of the measure said it would have raised at least $45 million annually for state schools and that it would recapture some of the money large chain stores like Walmart make in Wyoming.

But opponents worried about the precedent it would set by imposing Wyoming's first-ever income tax. Lobbyists for some of the companies that would have been targeted also argued it was unfair to those corporations because companies that did not meet the criteria for the tax would not have to pay any income tax.

While the bill initially had strong support among legislative leaders and had easily been approved by the Wyoming House of Representatives, the measure had generated increasing opposition in recent weeks.

More From KGAB