Corporate Income Tax Bill Filed In Wyoming Legislature

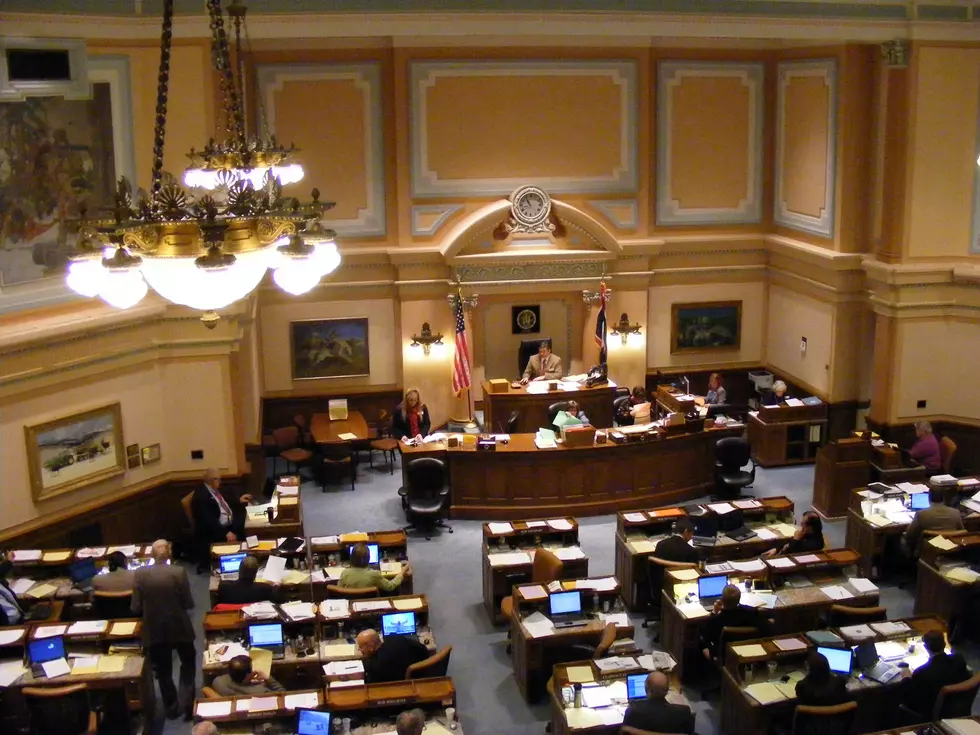

A bill that would impose a corporate income tax on companies with more than 100 shareholders has been filed for the upcoming 2020 session of the Wyoming Legislature.

You can read House Bill 64 here.

The bill would impose a 7 percent tax on eligible companies in the state. This year's bill has been broadened from a corporate income tax proposal which was defeated in 2019. Last year's bill would have only targeted companies in certain industries, such as large retail chain stores like Walmart, while those restrictions have been removed in the most recent proposal.

If it becomes law, House Bill 64 would raise about $23 million annually in revenues for state government, according to the fiscal note attached to the bill.

While House Bill 64 does not impose any kind of personal income tax on Wyoming residents. some critics of the legislation, such as economist Sven Larson with Americans For Tax Reform, say they are concerned a corporate income tax could be the first step in a process that eventually leads to a personal income tax in the Cowboy State.

Wyoming is currently one of the few U.S. states that do not have either a corporate or personal income tax. Wyoming lawmakers are grappling with ways to increase revenues in the face of project revenue shortfalls of several hundred million dollars in the coming years.

The situation is made worse because of a declining coal industry that has been a significant contributor to state coffers in the past.

The 2020 session of the Legislature will get under on Feb. 10 in Cheyenne.

More From KGAB