5 Places You Probably Shouldn’t Use Your Debit Card

Debit cards are a hot topic, rather than credit cards, for they allow you to draw money out of your checking account without writing a check. But beware when using them. Here are 5 reasons why you probably shouldn't use your debit cards. You can draw money out of your account with credit card protections that may help you avoid some of these pitfalls. Of course, talk to your banking institution for more details on that.

- At the Gas Pump - A friend of mine pumped gas at a local fueling station and they charged him a lot of money on top of what he was to pay at the pump. Some gas stations will put a hold on your account for 3 - 4 days that could cause balancing problems in your checking account. Might be best to pay cash or pay the attendant inside the station.

- Automatic Draft Accounts - This can be dangerous because after you terminate with the utility or phone company, they may continue to draw from your account. There are some companies that I do not allow to draw from my account. My mortgage company is one of them.

- Booking an Advanced Trip - Experts say that you're probably better off using a credit card when booking trips and tours. It has been shown that when there is an economic downturn, some of these companies can go bust. Credit cards will provide you protection against this, rather than a debit card.

- Buying On-Line - Not a good idea to use a debit card when purchasing items on-line. You're better off with a credit card, or a debit credit card because of the protections they provide.

- At the Grocery Store - Some months ago, supermarkets were hit by skimmers who were skimming on peoples debit cards by reading them in the check out lines.

More From KGAB

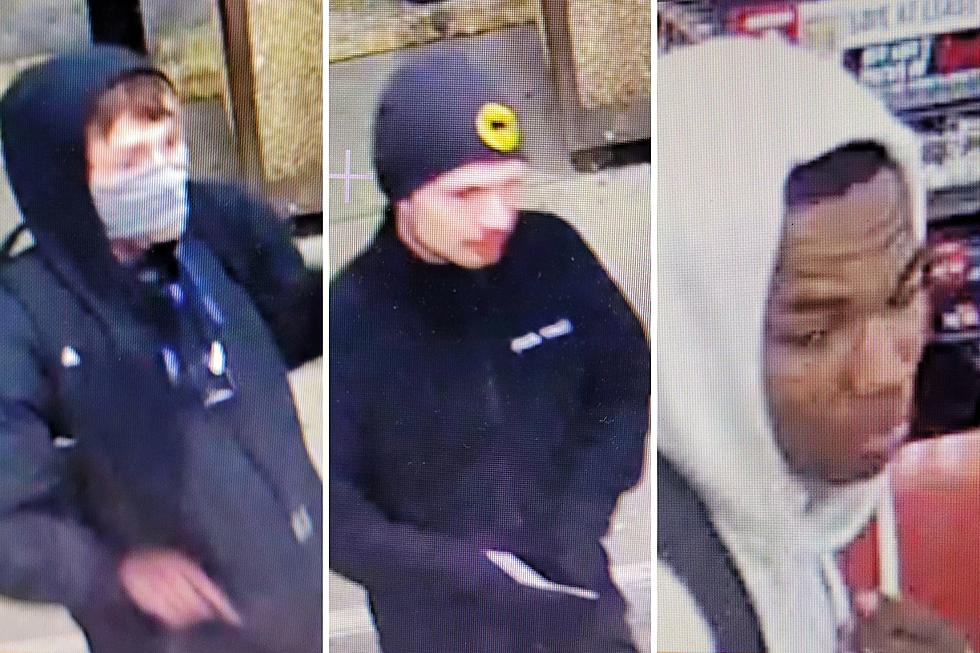

![UPDATE: Cheyenne Police Identify Fraud Suspects [PHOTOS]](http://townsquare.media/site/99/files/2019/02/debit-card-fraud-01-resized.jpg?w=980&q=75)