Occidental Sells 1M Acres to Orion Mine Finance, Which Gets Trona Reserves

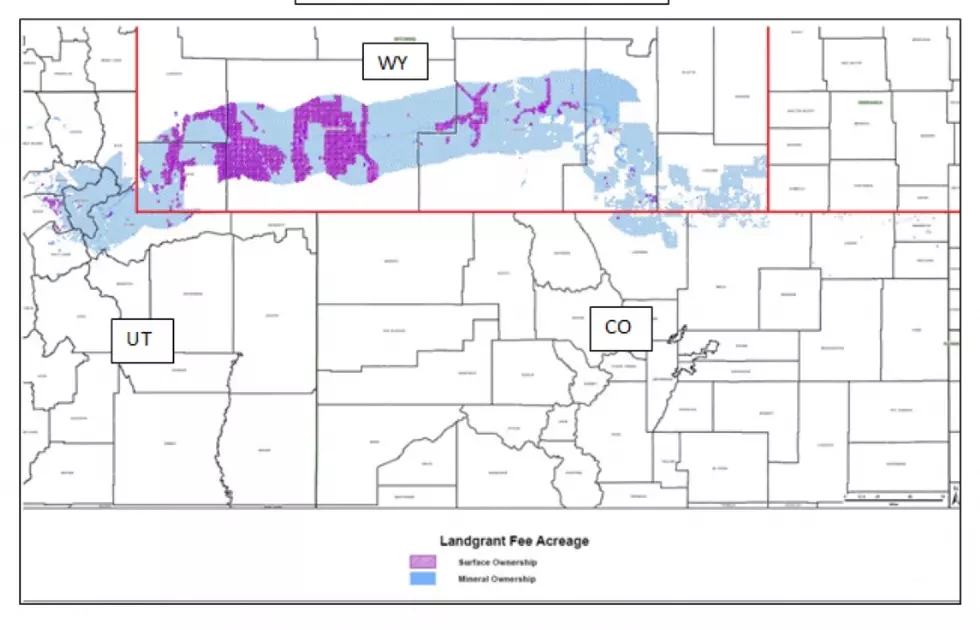

Occidental Petroleum announced Wednesday that it has sold an approximately 7,800-square-mile swath of land across southern Wyoming into eastern Utah to Orion Mine Finance for about $1.33 billion.

The sale, expected to close towards the end of the year, includes about 1 million acres of privately owned land and about 4.5 million mineral acres.

It also marks the end of Wyoming's bid for the land, which Gov. Mark Gordon said represented a once-in-a-generation opportunity to diversify the state's investments. It would have been largest public purchase of land since President Andrew Johnson's administration bought Alaska from Russia in 1867.

Wednesday afternoon, Gordon expressed his disappointment that Wyoming didn't get to buy the land, which was part of the original land grant to the Union Pacific Railroad.

"We worked hard to prepare a responsible, good faith bid, which we believe would have augmented Wyoming’s investment returns, bringing in more revenue to keep taxes in Wyoming low," he said in a prepared statement.

Last week, Gordon announced the bid was on hold.

"Had Wyoming’s bid been accepted, the rate of return was expected to be in the range of 8% to 12%, depending on the assets and how quickly the economy recovers," he said. "This predicted rate of return is currently better than our current average rate of return.”

The purchase also would have made it easier to manage checkerboard lands in southwestern Wyoming, furnish more and better public access for recreation, and give Wyoming more tools to oversee development.

The Governor and other members of the State Land and Investment Board planned to use Wyoming’s Permanent Funds for the purchase. The Constitution requires that those funds are only available for prudent investments, as guided by state statute, and are not available to help offset current budget shortfalls or to directly pay for the costs of running the government.

In the deal, Occidental will retain all cash flow from currently producing oil and gas properties on the position, which are primarily cost-free royalties.

“This transaction significantly advances the progress against our $2 billion plus divestiture target for 2020,” Occidental President and CEO Vicki Hollub said in a news release. “We will retain our core oil and gas assets in the Rockies, including the prolific DJ Basin in Colorado and the highly prospective Powder River Basin in Wyoming.”

Orion will acquire mineral rights to the world’s largest known trona deposit mostly in Sweetwater County. Trona is used to make soda ash, the principal ingredient in baking soda, global glass manufacturing, pollution control systems, as and other chemical applications.

Oskar Lewnowski, Chief Investment Officer of Orion, said acquiring high-quality producing royalties is a core component of the company's investment strategy. "This transaction offers significant royalty cash flow from the trona mines and has strong potential for mineral development.”

The acquired properties will be held under Sweetwater Royalties, a new base metals and industrial minerals royalty company, managed by Orion.

John Dutton's "Yellowstone" Ranch is Real and Here are 12 Pics

MUST SEE: John Dutton's Yellowstone Ranch is Real and Here are 12 Pics

MUST SEE: John Dutton's Yellowstone Ranch is Real and Here are 12 Pics

More From KGAB