Poll: Does Wyoming Need A State Income Tax?

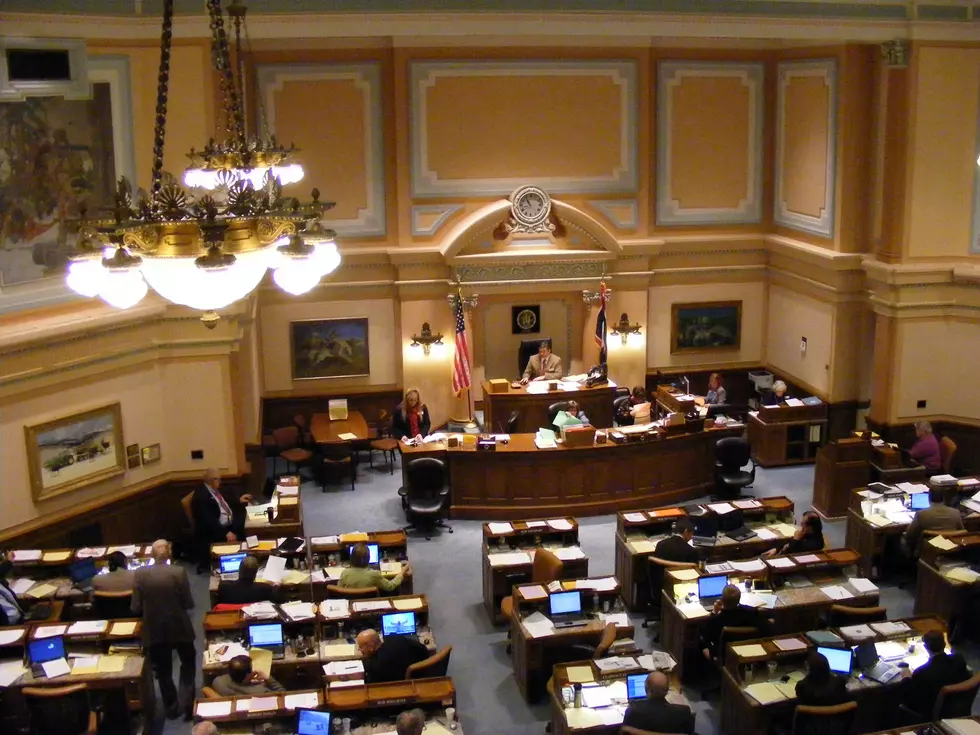

The state of Wyoming is facing major revenue challenges in light of low energy prices and a downturn in the state economy.

Money from taxes on the energy and minerals industries have traditionally provided the bulk of revenues for state government operations in the state, and no one is certain when or if those revenue streams will recover.

Meanwhile, Governor Matt Mead has said the state faces a "crisis" in education funding that needs to be addressed now. The governor has also said the state "can't cut its way out of" projected budget shortfalls over the next few years.

The governor has not said anything about an income tax, however.

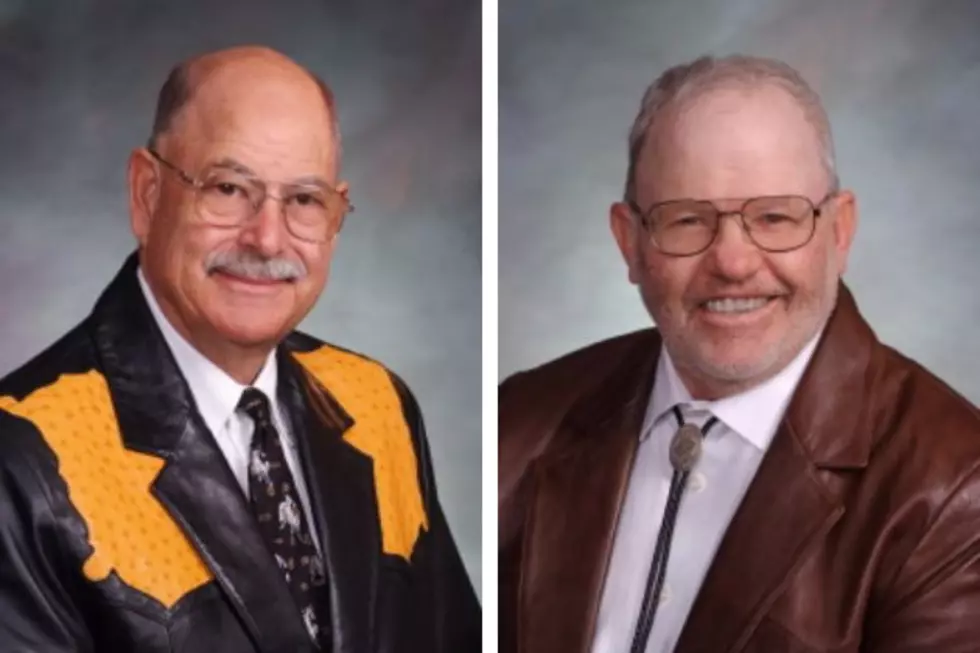

Economist Sven Larson says he thinks lawmakers will have to implement an income tax within the next few years unless steps are taken now.

He says those steps should include serious cuts in state government and a rollback in many of the regulations governing businesses in the state. Otherwise, Larson says an income tax is the only tax that could raise the kind of money the state needs to deal with budget shortfalls that he says could reach as high as $900 million by 2022.

What should lawmakers do? Is a state income tax the solution?

More From KGAB